Through planned giving, our generous donors have helped shape the future of WellSpan York Hospital and the communities we serve. These are their stories.

Rick and Sue Martin

Rick and Sue Martin, lifetime residents of the York community and longtime supporters of WellSpan York Hospital, give to say thank you for the care provided to them and their family members and to create a legacy.

“We are so lucky to have such a great facility in the area and so proud of the many services they offer,” says Sue.

“Including WellSpan York Health Foundation in our will is our way to create a legacy,” says Rick. “And the more you get involved, the more you see what they’re doing next, what they’re raising money for and see your money at work, the more you want to give!”

Gifts like the Martins’ have an immeasurable impact on WellSpan York Hospital. And no matter the gift size or type, your gift can support what matters most to you.

Consider designating WellSpan York Health Foundation as a beneficiary of your IRA*. By doing so, you may meet your charitable goals, reduce your taxable income and create a meaningful legacy for the future without affecting your current assets or cash flow.

*If you prefer to give annually, making a charitable rollover from your IRA this year is a smart way to do so!

Tony and Stef Campisi

Tony and Stef Campisi generously support many causes in York County, with healthcare being high on their list of priorities.

As a former WellSpan York Hospital Board of Directors member, Tony intimately saw why strong community support is critical to having excellent healthcare. He also helped establish the WellSpan York Health Foundation along with many other leadership roles he has held in the community. He credits his longtime mentor, Arthur J. Glatfelter, for instilling a deep commitment to philanthropy, both personally and as CEO of the Glatfelter Insurance Group.

Stef has been passionate about promoting the health of thousands of children through her many years of leadership in the Tennis for Kids program. Together, Tony and Stef are passing along their philanthropic values to their children and grandchildren.

By including WellSpan York Health Foundation in their estate plans and involving family, they are demonstrating their commitment to ensuring superior healthcare for the residents of York County for generations to come.

Chloe Eichelberger

“Following a major accident, I was rushed to WellSpan York Hospital to begin what would be a 57-day battle for my life,” says Chloe Eichelberger.

“Ultimately, they did save my life, and I became aware of so many things I had not considered before.”

Recognizing how fragile and fleeting life can be and how a great hospital can tip the scales to save lives, Chloe decided to include WellSpan York Health Foundation in her estate plans.

“We must work together to ensure that WellSpan York Hospital can continue to offer state-of-the-art care to everyone who needs it,” she says.

With Chloe’s gift, she joins families, individuals, grateful patients, clinicians and community members in the Samuel and Isabel Small Legacy Society, a special group of supporters who have included WellSpan York Health Foundation in their estate plans, continuing their legacy of supporting excellent healthcare for the generations that follow.

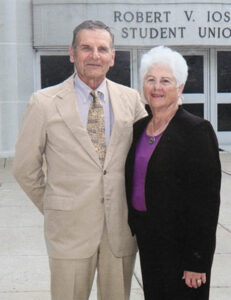

Dr. and Mrs. Iosue

Dr. and Mrs. Iosue have impacted many lives with their leadership and support of WellSpan York Hospital and the entire community — and their legacy will continue.

The Iosues have a special passion for helping to fund cardiovascular research. By designating the WellSpan York Health Foundation as the beneficiary of a portion of their IRA*, they will help the WellSpan York Hospital cardiovascular team remain leaders in treatment and care for residents of York County and beyond. By donating IRA funds directly to the Foundation, all taxes are avoided.

“We give to support excellence in healthcare,” they say.

Dr. and Mrs. Iosue join many families, individuals, grateful patients, clinicians and community members in the Samuel and Isabel Small Legacy Society. We invite you to join them, too.

* If you are 70½ or older, you can maximize your giving by making a Qualified Charitable Distribution. Simply request a distribution from your IRA and provide your financial advisor with WellSpan York Health Foundation’s gift language. A gift from your IRA will cost you nothing and will greatly impact our ability to provide care to those we serve. You will pay no taxes on the distribution (contact us or your advisor for the terms and conditions of qualified charitable distributions).

Valerie Hardy-Sprenkle

Valerie Hardy-Sprenkle was called to be a nurse early in her studies, and she went on to enjoy a 40-year career in nursing. Her experience confirmed that nurses play a critical leadership role, so she established a gift that endows a scholarship to support the WellSpan York Hospital nurses who have demonstrated leadership potential.

Valerie’s gift honors her parents for their investment in her career. It demonstrates for her children, grandchildren and their children the importance of paying it forward to impact the lives of others and benefit the community. It celebrates the past while inspiring the future.

Do you think about your legacy and how you want to be remembered? Including WellSpan York Health Foundation in your will is a perfect way to make a difference while leaving a lasting, positive legacy. It’s easy to do and costs you nothing today.

YOUR HEALTH. YOUR STORY. YOUR LEGACY.

Let’s plan it together.

When you’re ready, please get in touch with us. We’re here to discuss options that align with your goals and values and provide helpful information to share with your financial advisor or estate planner.